Click on the video below to access a two minute video to explore if you’re a marshmallow or acorn thinker.

ESG (Environment, Social Concerns, Governance) ratings are increasingly influencing financial decisions, with potentially far-reaching effects on asset prices and corporate policies. Investors with over $80 trillion in combined assets have signed a commitment via UN-PRI to integrate ESG information into their investment decisions, signalling growing expectations from investors that companies take ESG issues seriously.

ESG rating agencies have become influential institutions. However, ESG ratings from different providers disagree substantially. This means that the information that decision-makers receive from ESG rating agencies is relatively noisy.

ESG ratings have a number of limitations by design. First, ratings want to be too many things to too many people. They have little focus on material issues, although it is crucial from investment purposes to focus on material issues. Secondly, the ratings are based on reported data and policies, which are only a fraction of what is needed for a good assessment and are sometimes even conflicting.

Unlike creditworthiness, which is relatively clearly defined as the probability of default, the definition of ESG performance is less clear. It is a concept based on values that are diverse and evolving. Therefore, an important part of the service that ESG rating agencies offer is an interpretation of what ESG performance means. While financial reporting standards have matured and converged over the past century, ESG reporting is in its infancy. There are competing reporting standards for ESG disclosures and almost none of the reporting is mandatory, giving corporations broad discretion regarding whether and what to report.

If consideration of sustainability factors in the investment decision making and advisory processes only rely on ratings, this can lead to adverse outcomes beyond the financial markets. In turn, these adverse impacts will decrease the resilience of the real economy and the stability of the financial system and in so doing can ultimately influence the risk-return profile of financial products.

I’m looking forward to how the proposed Regulatory Technical Standards on content, methodologies and presentation of future disclosures via the European Supervisory Authorities, (EU) 2019/2088 (Sustainable Finance Disclosure Regulation “SFDR”) will influence ratings from March 2021. From this date, financial market participants and financial advisers will be required to disclose specific information on their approaches to the integration of sustainability risks and the consideration of adverse sustainability impacts.

Put your headphones on to dive deeper into the noise of ESG Rating Agencies.

The recent corporate scandals involving well-known companies such as Wells Fargo, Volkswagen, and Facebook have kept ESG strategies in the headlines. At the same time, investors have been migrating away from actively managed strategies and toward passive management. The rise of ESG investing coupled with the growing popularity of passive investing has made the quality and availability of systematic ESG ratings data ever more important.

Unfortunately, the quality of ESG ratings data can be deficient due to a lack of coverage and a dependence on self-reporting. This inadequacy is often cited as one of the largest impediments to investors who would like to enter the ESG space.

The ESG arena is characterised by a large number of rating agencies offering a very wide array of data, from specialised providers that calculate metrics on specific ESG traits, such as carbon score and gender diversity, to providers that rate companies based on several hundred ESG-related metrics. Knowing where to start when evaluating data providers is a significant task and no single public source or directory offers a comprehensive overview of data providers.

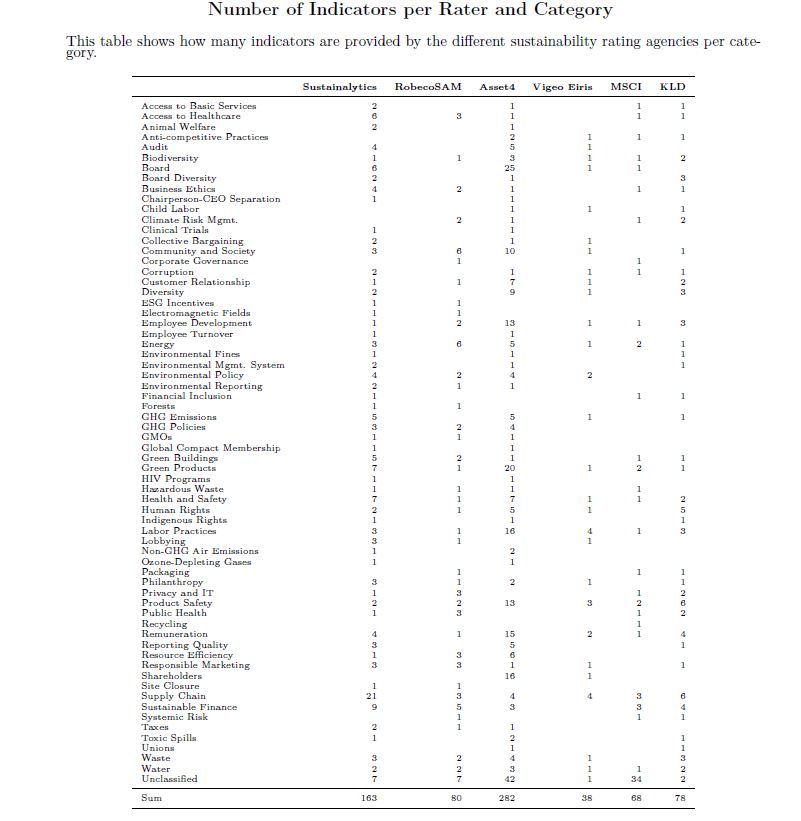

2019 research from MIT Sloan and the University of Zurich “Aggregate Confusion:The Divergence of ESG Ratings”, notes the number of categories, and the the divergent weights placed on them. (see below)

Although only six raters have been included below, at the end of 2017, seventy different firms that provide some sort of ESG ratings data were identified.

Where does an ESG investor begin?

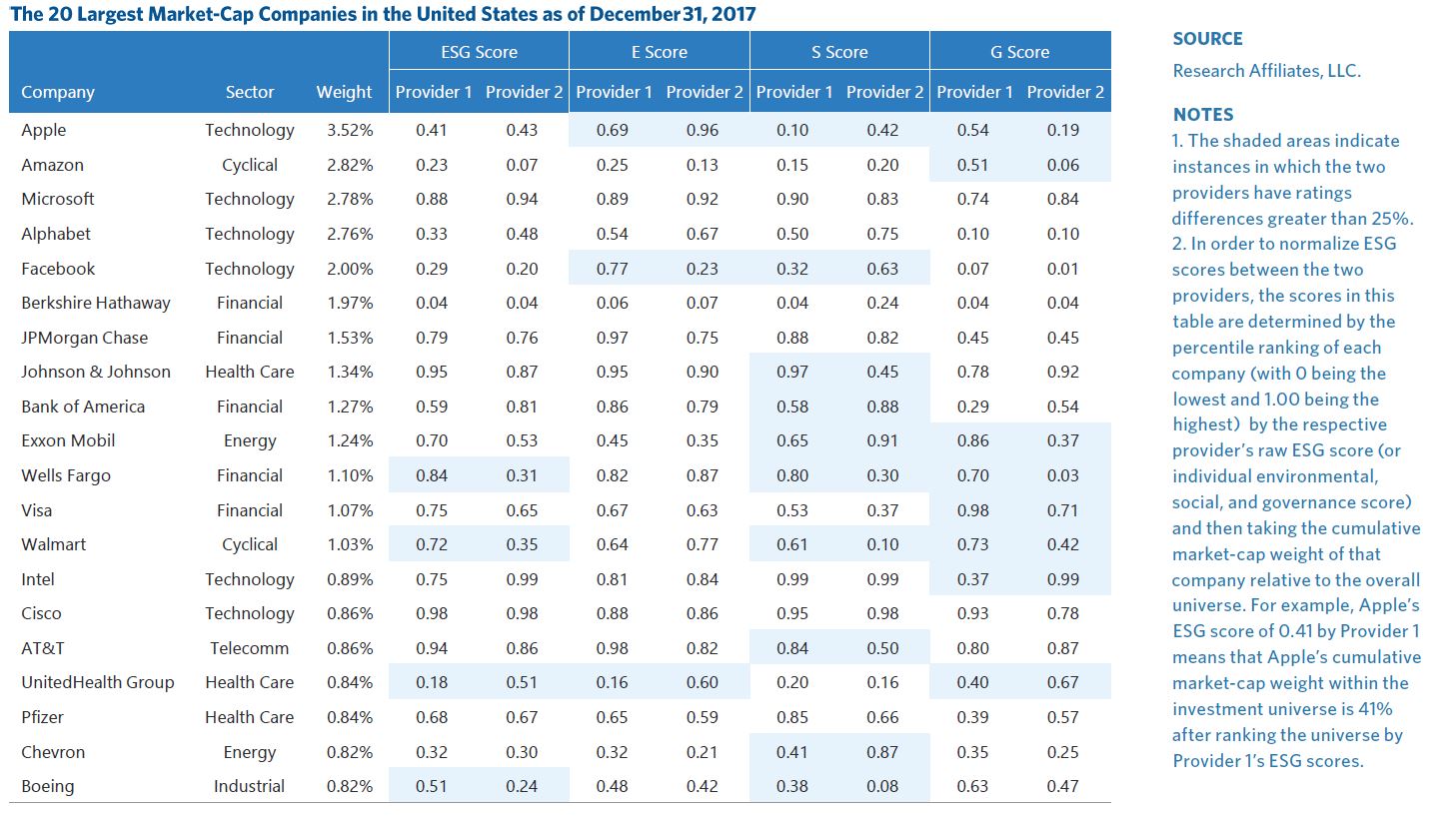

Now, turn your focus to the figure below, indicating a three-tiered framework, namely E, S and G, based on the 20 largest market-cap companies in the US as of Dec 31 2017.

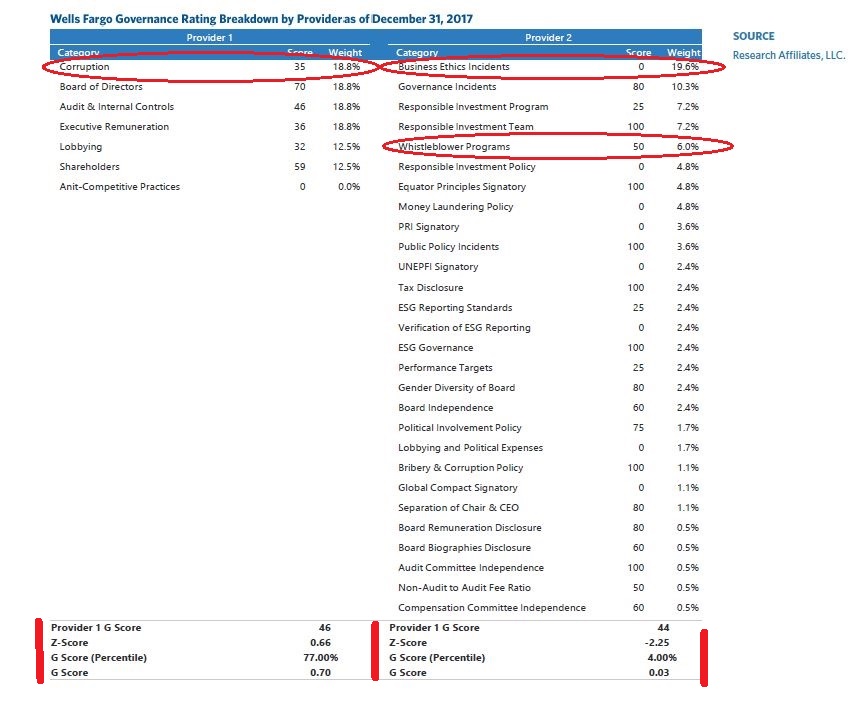

To illustrate how ESG ratings agencies can evaluate the same company very differently, let’s look more closely at the governance score for Wells Fargo and decompose it to its underlying metrics.

The first thing we observe is the difference in the metrics used by the two providers to evaluate the governance practices of Wells Fargo. At first pass, it appears that Provider 1 takes a much narrower view of governance, listing only 7 categories of assessment, while Provider 2 assesses governance along 28 categories. If we dig deeper into Provider 1’s methodology, however, Provider 1 also assesses many of the metrics used by Provider 2 as themes within each of its 7 categories. For example, Provider 2 separates out the OSHA Whistleblower Protection Programs a company has in place, while Provider 1 includes this as a theme when determining the corruption rating of a company.

Provider 1 ranks Wells Fargo in the top-third by governance in their universe, whereas Provider 2 ranks it in the bottom 5%. One of the biggest contributors to the ranking difference comes from the assigned score of zero on “Business Ethics Incidents” by Provider 2, which accounts for nearly 20% of the aggregate score calculation. These data were collected in 2017 when Wells Fargo was still in the middle of their very public fake account scandal. Highlighting a difference in methodology, the Wells Fargo account scandal would fall under Provider 1’s “Information to Customers” category, reflected in a company’s social score and not in their governance score.

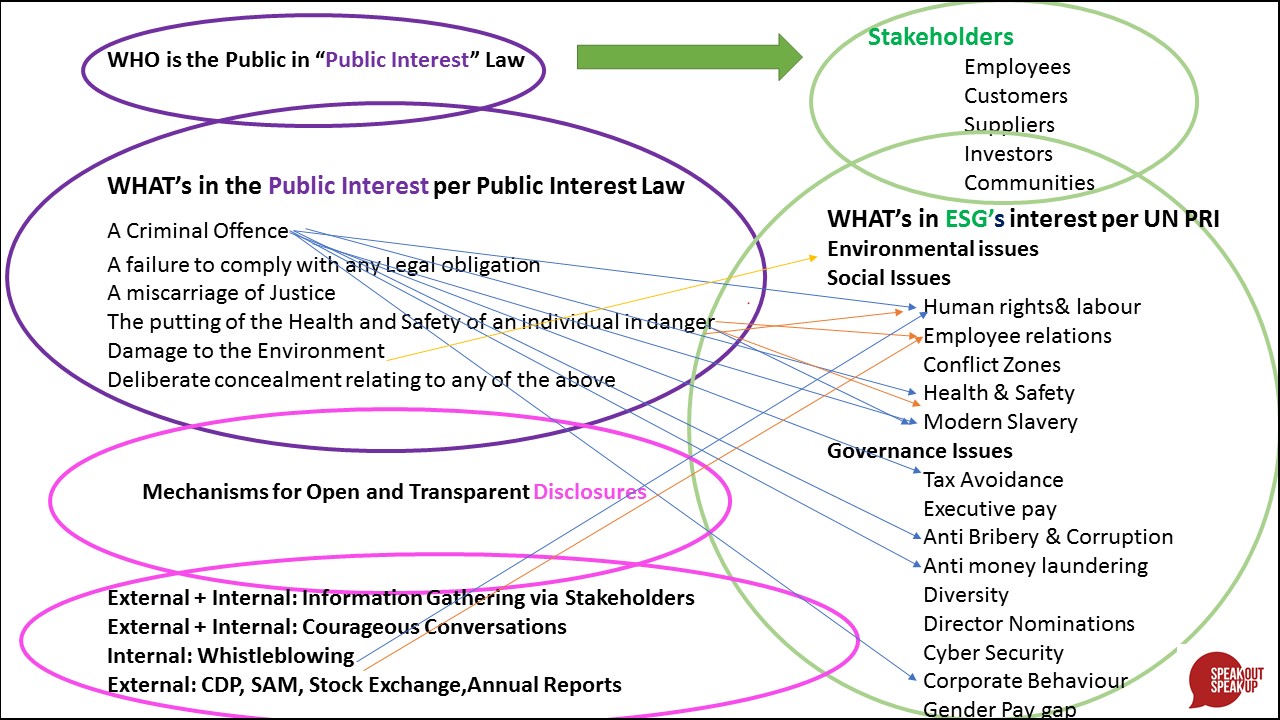

This divergence supports my call for formal whistleblower protection processes, contents of employee disclosures and outcomes for whistleblowers and the organisation to be separated out further and aligned to the 17 UN SDG Goals. Consider that Whistleblowers speak out for the planet, for people, for product, for good governance, so that organisations do better. Additionally, whistleblowing legislation is underscored by Public Interest law, in other words, with Stakeholders in mind. See below the correlation between Public Interest Law, Stakeholder theory and ESG’s interest per the UN PRI.

Weights and correlations will only be as helpful as the mindset, biases and understanding of the investor when considering the matrix of whistleblowing and the rating agency applying the weights. Education and training is required in this regard – https://speakout-speakup.org/services/whistleblowing/

What is driving the differences between existing ESG ratings?

ESG ratings are indices that aggregate a varying number of indicators into a score that is designed to measure a firm’s ESG performance. Conceptually, such a rating can be described in terms of scope, measurement, and weights. Scope refers to the set of attributes that describe a company’s ESG performance. Measurement refers to the indicators that are used to produce a numerical value for each attribute. Weights refers to the function that combines multiple indicators into one rating.

- Scope divergencerefers to the situation where ratings are based on different sets of attributes. The fact that a rating agency does not take a particular attribute into consideration is equivalent to assuming that it sets the attribute’s weight to zero in the aggregation function. In practice, however, rating agencies do not collect data for attributes that are beyond their scope. (Whistleblowing?) As a result, scope divergence is also an issue of data availability.

- Measurement divergence refers to a situation where rating agencies measure the same attribute using different indicators. Human Rights and Product Safety are categories for which such measurement disagreement is particularly pronounced. For example, a firm’s labour practices could be evaluated on the basis of workforce turnover, or by the number of labour-related court cases taken against the firm. Both capture aspects of the attribute labour practices, but they are likely to lead to different assessments.

- Measurement divergence is in part driven by a rater effect. This means that a firm that receives a high score in one category is more likely to receive high scores in all the other categories from that same rater. This is the cause of greatest divergence. A potential explanation for the rater effect is that rating agencies are mostly organised in such a way that analysts specialise in firms rather than indicators. A firm that is perceived as good in general may be seen through a positive lens and receive better indicator scores than a firm that is perceived as bad in general.

- ESG rating agencies usually divide labour among analysts by firm rather than by category.

- Some raters make it impossible for firms to receive a good indicator score if they do not give an answer to the corresponding question in the questionnaire. This happens regardless of the actual indicator performance. The extent to which the firms answer specific questions is very likely correlated across indicators. Therefore, a firm’s willingness to disclose might also explain parts of the rater effect.

C. Weights divergence emerges when rating agencies take different views on the relative importance of attributes. For example, the labour practices indicator may enter the final rating with greater weight than the lobbying indicator. The contributions of scope, measurement, and weights divergence are all intertwined, which makes it difficult to interpret the divergence of aggregate ratings.

Rating users have to deal with the problem that the divergence is driven both by what is measured and by how it is measured.

How might raters measure Whistleblowing? What number of Whistleblowing disclosures signal an open or a closed organisational culture? How will raters measure informal disclosures? A measure for outcomes for both the whistleblower and the organisation will be very illuminating. The data can come from various sources, such as company reports, public data sources, surveys, or media reports and I would be happy to help with data analysis in this regard.

What are the Consequences arising from the Noise of ESG Ratings?

- ESG performance is less likely to be reflected in corporate stock and bond prices, because investors face a challenge when trying to identify outperformers and laggards. Investor tastes can influence asset prices but only when a large enough fraction of the market holds and implements a uniform non-financial preference. Therefore, even if a large fraction of investors have a preference for ESG performance, the divergence of the ratings disperses the effect of these preferences on asset prices.

- The divergence hampers the ambition of companies to improve their ESG performance, because they receive mixed signals from rating agencies about which actions are expected and will be valued by the market.

- The ambiguity around ESG ratings represents a challenge for decision-makers trying to contribute to an environmentally sustainable and socially just economy.

Considerations for Investors, Organisations and Rating Agencies

Investors: seek to understand why a company has received different ratings from different rating agencies. The example of Wells Fargo above indicates how a company can disentangle the various sources of divergence and trace down to specific categories.

Organisations: work with rating agencies to establish open and transparent disclosure standards, and ensure that the data that you yourselves disclose is publicly accessible.

Rating Agencies: there’s a growing call for greater transparency. Clearly communicate your agency’s definition of ESG performance in terms of the scope of attributes and aggregation rule. Second, become much more transparent with regard to the measurement practices and methodologies utilised. Lastly, seek to understand what drives the rater effect, in order to avoid potential biases.

I hope you enjoyed my blog. Don’t keep it to yourself, share it. And get in touch, I’d love to be of support.

Leave A Comment