The ‘do no significant harm’ principle must extend to whistleblowers

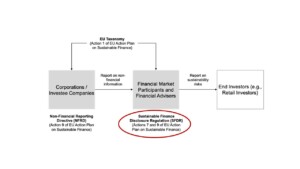

“Do no Significant Harm” is the principle that underscores the EU’s approach to sustainable growth, following the adoption of the 2015 Paris Agreement on climate change and the United Nations 2030 Agenda for Sustainable Development. The EU Commission has expressed in the Action Plan “Financing Sustainable Growth” its intention to clarify fiduciary duties and increase transparency in the field of sustainability risks and sustainable investment opportunities.

As an example, the Sustainable Finance Disclosure Regulation (SFDR) (Regulation (EU) 2019/2088) requires investments to comply with the ‘do not significantly harm’ principle to qualify as sustainable. The aim of this regulation is to :

• re orient capital flows towards sustainable investment in order to achieve sustainable and inclusive growth;

• assess and manage relevant financial risks stemming from climate change, resource depletion, environmental degradation and social issues; and

• foster transparency and long-termism in financial and economic activity.

Welcome to the world of EU Taxonomy for Sustainable Finance.

The SFDR regulation is on the minds of many investors these days. My concern is how it conflicts with the lack of legal protection for EU climate whistleblowers, who are and will be significant to this sustainable finance model and beyond.

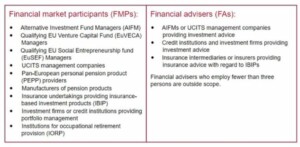

The EU SFDR regulation requires investors to ‘provide adequate information in relation to matters that stand out as being most likely to bring about the materialization of principal risks of severe impacts, along with those that have already materialized’. SFDR introduces rules requiring certain asset and fund managers, as well as advisers listed in the table below, to comply with specific rules on ESG disclosures.

These entities will need to provide retail investors with pre-contractual information, disclosures on their websites and disclosures in periodic reports under relevant sector regulation. Naturally, this will require changes to their internal processes, procedures, and policies to comply with these new requirements

As a regulation, SFDR is immediately applicable in EU member states though not technically law in the UK as it did not come into force until after the transitional period ended.

In its current form the SFDR, which has been in force since 10 March 2021 is in the “level 1 stage of development” which sets out the basic framework principles without specifying technical details.

SFDR level 2 will come into force once the regulation is complemented by Regulatory Technical Standards (RTS), which are being developed right now based on the ‘do no significant harm’ concept. These will form part of the pre-contractual information needed for the statement on considering principal adverse impacts of investment decisions on sustainability factors.

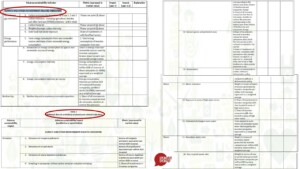

Drilling down into the draft RTS, I’m gratified to note that a potential investor will have to disclose whether an investee organisation has a whistleblowing policy within Annex 1, named the Template of Principal adverse impacts statement ; See Table 3, within Annex 1, under the heading SOCIAL AND EMPLOYEE, RESPECT FOR HUMAN RIGHTS, ANTI-CORRUPTION AND ANTI-BRIBERY MATTERS).

This tick-box exercise however merely requires an investor to enquire whether the investee organisation has a whistleblowing policy and nothing more. Having a policy is not the same thing as building a workplace channel that’s conducive to speaking-listening up. This is one of the reasons I’m advocating for this to be broadened.

The ‘do no significant harm’ principle must extend to whistleblowers.

The inclusion of whistleblowing as a material metric to sustainable investing is acknowledgement that an investee organisation without a whistleblowing policy protecting potential whistleblowers puts investments at risk.

Much more than investments are at risk however. Currently the EU Whistleblowing directive, to be transposed into national law by the Member States by 17 December 2021, does not specifically identify climate whistleblowers as disclosers requiring protection.

There is a puzzling incongruence between the EU Whistleblowing Directive and the Template of principal adverse impacts statement‘, Annex 1, Table 1 and Table 2 for the SFDR. Annex 1 has a total of 43 measures, 27 of them under the heading CLIMATE AND OTHER ENVIRONMENT-RELATED INDICATORS (Table 1) and ADDITIONAL CLIMATE AND OTHER-RELATED INDICATORS (Table 2). See abbreviated image below. These headings suggest that climate indicators are of primary concern and ‘other environment-related’ indicators are of secondary concern.

If climate indicators are dominant metrics, why are EU Climate Whistleblowers unprotected under the EU Whistleblowing Directive?

I would like to see the EU Whistleblowing directive extend and specify the protection of EU climate whistleblowers, aligning with the EU taxonomy set out for the SFDR, RTS, Annex 1, Table 1 and Table 2.

Pursuant to Article 2 of the EU Whistleblowing Directive the Directive’s provisions are only the “common minimum standards for the protection of persons reporting breaches of [EU] law”. As the RTS is in draft form, I see a unique opportunity for EU nations to easily add reporting violations of climate laws and policies as, at minimum, a sub-definition of environmental whistleblowing and in alignment with indicators within the Template of Principal Adverse Impacts Statement, Annex 1, Table 1 and Table 2. By doing so, EU nations will be mirroring the EU SFDR regulation and building synergy, trust and alignment.

See my short two minute video campaigning for these changes to be made and read more on the National Whistleblowing Centre website

It’s ambiguous, incongruent and out of alignment with the principle of “do no significant harm’, to require investors to request confirmation of a whistleblowing policy from investee organisations without reference to the legal imperative to protect climate whistleblowers.

Get involved, share my blog!